PHILIPSBURG:--- With fresh topics and familiar goals, the Cyber Senior workshop series returns for another 8-month session. This initiative empowers mature adults to engage, explore, and excel with today’s digital tools, technologies, and resources that enhance their well-being.

PHILIPSBURG:--- With fresh topics and familiar goals, the Cyber Senior workshop series returns for another 8-month session. This initiative empowers mature adults to engage, explore, and excel with today’s digital tools, technologies, and resources that enhance their well-being.

Registration opens on Monday, January 26, 2026, and will close on Saturday, January 31, 2026. Classes begin on Tuesday, February 3, 2026, at Belvedere Estate #3, Belvedere Satellite.”

Our dedicated Cyber Senior Media Coaches look forward to welcoming both new and returning students to a program rich with learning, growth, and opportunity. To register, contact the Sint Maarten Library at +1-721-542-2970 or email This email address is being protected from spambots. You need JavaScript enabled to view it.. Enrollment is limited, so early registration is recommended.

Empower yourself or a loved one with essential digital skills that promote independence, convenience, and meaningful connection. Join the Cyber Senior Program and take the next step toward digital confidence.

Stay connected with us on Facebook, Twitter, Instagram, and YouTube for updates and resources.

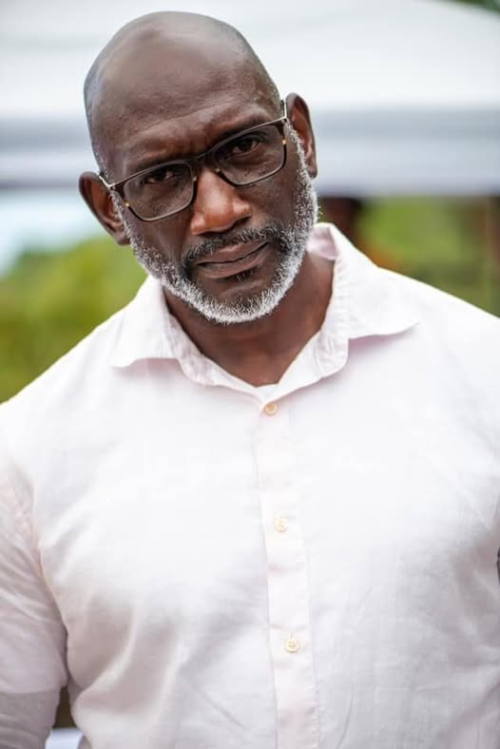

National Alliance Congratulates Michael Peters on Appointment at PJIA.

PHILIPSBURG:--- The National Alliance Party congratulates St. Maarten’s very own Michael Peters on his appointment as Operations Director at Princess Juliana International Airport.

Michael’s story is one we love to see. He started out as a summer employee and, through hard work, discipline, and commitment, worked his way up to one of the most important operational roles at our national airport. That kind of growth does not happen by chance. It happens when talent meets opportunity and when people are willing to put in the work.

As a son of the soil, Michael Peters is proof that local professionals can lead at the highest levels when they are given the chance. His deep knowledge of the airport and steady rise through the ranks show the value of investing in people who understand our institutions and care about doing the job right.

The National Alliance believes strongly in empowering our own. Building St. Maarten means trusting local talent, supporting growth, and creating pathways for our people to succeed. Michael’s appointment sends a positive message to young people across the island that dedication and perseverance truly matter.

We wish Michael Peters continued success as he takes on this important responsibility at the heart of our country’s main gateway.

Business Hoops SXM Continues to Invest in the Future of Local Basketball.

PHILIPSBURG:--- Business Hoops SXM once again demonstrated that its vision extends far beyond organizing competitive tournaments, as the organization made a meaningful contribution to youth basketball development on Thursday night at the L.B. Scott Sports Auditorium.

PHILIPSBURG:--- Business Hoops SXM once again demonstrated that its vision extends far beyond organizing competitive tournaments, as the organization made a meaningful contribution to youth basketball development on Thursday night at the L.B. Scott Sports Auditorium.

Following an exciting Souliga Youth Basketball Association (SYBA) game, Business Hoops SXM officially presented a new iPad to SYBA during a brief ceremony at 8:00 PM. The donation was made by the founders of Business Hoops, Jose Helliger and Cleon Frederick, and accepted by SYBA President Jamal Newton.

The tablet will play a vital role in helping SYBA modernize its operations, enabling the association to more efficiently track player statistics, including scoring, rebounds, assists, and overall game performance. According to SYBA officials, improved data collection will enhance player development, evaluation, and long-term planning for the league.

This initiative is in line with Business Hoops SXM’s broader mission—one that prioritizes giving back to the sport and strengthening basketball's grassroots foundation. While Business Hoops has become widely known for its high-energy corporate tournament, the organization has consistently emphasized that community impact and youth development remain at the heart of its efforts.

That commitment will be on full display during the 2026 Business Hoops Tournament, which runs from January 28 through February 7. Adding to the excitement, two SYBA games will be featured on Saturday, January 31, allowing young athletes to compete on a larger stage and in front of a wider audience.

As Business Hoops SXM continues to grow, moments like Thursday night’s donation serve as a reminder that the true value of sport lies not only in competition, but in investment—investment in young players, strong programs, and a sustainable future for basketball on the island.

For full game schedules, tournament updates, and more information, visit businesshoopssxm.com. Fans are also encouraged to follow Business Hoops SXM on Facebook, Instagram, and YouTube for ongoing coverage and highlights.

Head of Immigration Dismissed Amid Performance Concerns and Backlogs

PHILIPSBURG:--- Mr. Jocelyn R. Levenstone, a veteran law enforcement and border control professional with nearly 35 years’ experience, was dismissed on Friday from his post as head of Sint Maarten’s Immigration Department by Minister of Justice Nathalie Tackling. Despite his extensive background—which includes key roles with the Dutch Caribbean Coastguard, Port Sint Maarten, and as a police officer—Levenstone’s leadership faced escalating challenges leading to his removal after persistent concerns about underperformance and operational backlogs.

PHILIPSBURG:--- Mr. Jocelyn R. Levenstone, a veteran law enforcement and border control professional with nearly 35 years’ experience, was dismissed on Friday from his post as head of Sint Maarten’s Immigration Department by Minister of Justice Nathalie Tackling. Despite his extensive background—which includes key roles with the Dutch Caribbean Coastguard, Port Sint Maarten, and as a police officer—Levenstone’s leadership faced escalating challenges leading to his removal after persistent concerns about underperformance and operational backlogs.

Levenstone had been appointed to the leadership position in October 2023, bringing with him a long record in law enforcement, crime prevention, maritime security, and public safety oversight. His appointment was seen as a move toward greater departmental effectiveness, building on experience as Manager of Safety and Security at Port Sint Maarten and as Head of the Coastguard Substation on Sint Maarten. However, these functions and experiences were ultimately overshadowed by mounting difficulties within the department.

According to well-placed sources, numerous employees had submitted detailed letters to Minister Tackling since her appointment, outlining a variety of issues within the department. Their concerns ranged from a difficult workplace climate to repeated failures in leadership and management. Despite repeated warnings, the backlog of residency permits and other essential services continued to climb, impacting residents and contributing to widespread dissatisfaction.

Minister Tackling delivered the news in a comprehensive five-page letter, clearly spelling out the department’s challenges and the specific grievances raised by staff. Employees said they were surprised by the timing of the decision, noting that although frustration had been building, few expected such a decisive move.

Complicating matters further, Levenstone had recently applied for the position of governor of Saba, highlighting the stakes of his abrupt removal. The Ministry of Justice now faces the urgent task of tackling the backlog and rebuilding public trust in immigration services as the search for new leadership moves forward.

When Announcements Outpace Action: Seeking Clarity on St. Maarten’s Traffic Plans.

PHILIPSBURG:--- Traffic congestion on St. Maarten is not worsening due to a lack of discussion. It is deteriorating due to a lack of execution. Every day of delay compounds economic cost, public frustration, and lost confidence in governance. When public announcements about solutions begin to contradict one another, the problem extends beyond the roads themselves. In such circumstances, clarity is not optional but necessary.

PHILIPSBURG:--- Traffic congestion on St. Maarten is not worsening due to a lack of discussion. It is deteriorating due to a lack of execution. Every day of delay compounds economic cost, public frustration, and lost confidence in governance. When public announcements about solutions begin to contradict one another, the problem extends beyond the roads themselves. In such circumstances, clarity is not optional but necessary.

On 23 December 2024, The Daily Herald reported that the Minister of VROMI had engaged the United Nations Office for Project Services (UNOPS) to develop a comprehensive action plan to alleviate traffic congestion on the island. The language at the time conveyed a clear impression that a technical process had already been initiated and that strategic solutions were being actively pursued.

More than a year later, on 16 January 2026, the Government of Sint Maarten announced the signing of a Letter of Intent between the Ministry of VROMI and UNOPS to improve national mobility. One is left to wonder whether the public is being informed of a new milestone or being asked to re-read last year’s announcement under a different headline.

Taken together, these two announcements appear to describe the same process, separated not by outcomes but by time.

This sequence raises several fundamental questions that deserve clear answers:

- Does the Letter of Intent represent the conclusion of the traffic study referenced in December 2024, or the formal start of it?

-If it marks the start, what explains the more than one-year gap between public announcement and signing?

- If the study was completed, why have its findings, timelines, and recommendations not been disclosed?

- If the study is still to be conducted, what are the specific deliverables, timelines, and decision points the public should expect from it?

If the Letter of Intent is indeed the starting point of work first announced in December 2024, then the timeline suggests a prolonged period between intention and execution. Absent a clear explanation, such a delay risks being interpreted as inaction rather than strategy, particularly on an issue that has only intensified with time.

If, on the other hand, the study was already conducted during the intervening period, then transparency requires that its findings be shared. To date, no traffic analysis, recommendations, timelines, or implementation framework have been made public to demonstrate that such preparatory work took place.

What further complicates matters is that both announcements, despite being more than a year apart, were framed as progress. Yet progress, by definition, implies movement from one stage to the next. Without clarity on which stage we are actually in, repeated announcements risk creating the appearance of action rather than its substance.

When official public statements consistently require post hoc clarification to reconcile them with timelines and facts, it inevitably raises concerns about whether communication is being used to inform the public or to manage perception.

This is not a semantic debate. Traffic congestion carries tangible costs. Delayed emergency response times, lost productivity, increased fuel consumption, higher operating expenses for businesses, and daily frustration for residents are all real and measurable impacts that demand urgency, not uncertainty.

As a Member of Parliament, I have formally written to the Minister of VROMI seeking clarification on these matters, as I am receiving questions from residents who have been following these developments closely and are struggling to reconcile the narrative being presented with the timeline observed.

St. Maarten does not lack announcements. It suffers from delayed execution. Clear timelines and disclosed deliverables would allow Parliament and the public alike to assess progress on substance rather than announcements. Clear answers at this stage would help restore trust, align expectations with reality, and demonstrate the seriousness of purpose that this issue demands.

Traffic solutions cannot be built on circular messaging. They must be built on clarity, timelines, and results.