WILLEMSTAD/PHILIPSBURG — Transaction fees of local banks in Curaçao are among the lowest in the region. That is the outcome of a comparative analyses of bank transaction fees in Curaçao and Sint Maarten valid per 2022 conducted by the Centrale Bank van Curaçao en Sint Maarten (CBCS). In this analysis the transaction fees of local banks are compared with several countries in the region and the Netherlands. The countries included in the comparison are Aruba, Bahamas, Barbados, Belize, Jamaica, Sint Maarten and Trinidad & Tobago. The research was conducted in cooperation with all 7 local banks and 1 credit institution in Curaçao and was a follow up on previous research by the CBCS titled ‘Households’ financial affairs in Curaçao 2020’. 81% of the respondents at that time agreed that there is a need to reduce the transaction fees, implying these fees are too high. In view of this, the CBCS committed itself to investigate the extent of this matter.

Fees development 2022 vs 2019

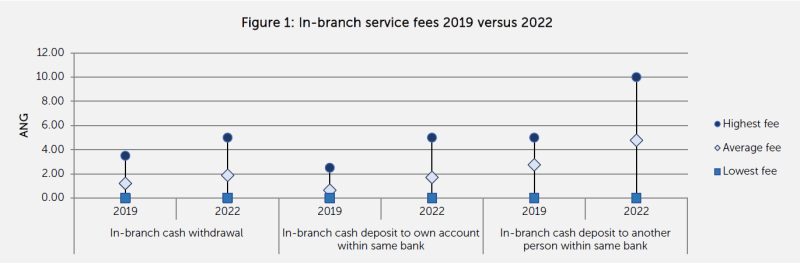

The CBCS compared previously collected fees per 2019 with the current fees per 2022 to see whether there have been fee changes during the last few years. The results show that since 2019 most banks increased their administration fees, especially their in-branch service fees (Figure 1)1. However, the online banking services remained free of charge or in some instances even decreased in the effort to promote the use of digital payments.

1 Figure 1 is an example for the personal debit account.

Curaçao vs the region

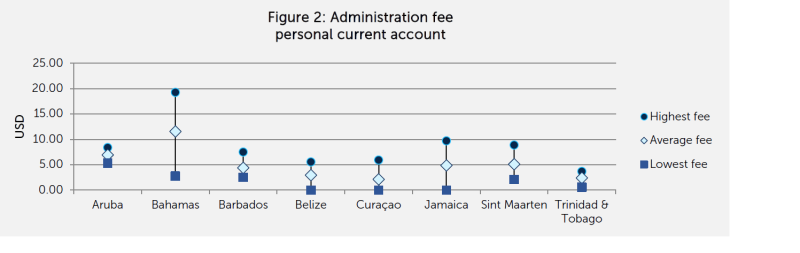

Based on the CBCS’ research, transaction fees in Curaçao are not the most expensive, nor the cheapest compared to the region, however, Curaçao emerges as the most affordable in some cases. The results point out that, compared with countries in the region, the average administration fee in Curaçao for both the personal account and the business account are among the lowest.

Figure 2 illustrates the administration fee for personal accounts, where, on average, Curaçao is the second least expensive.

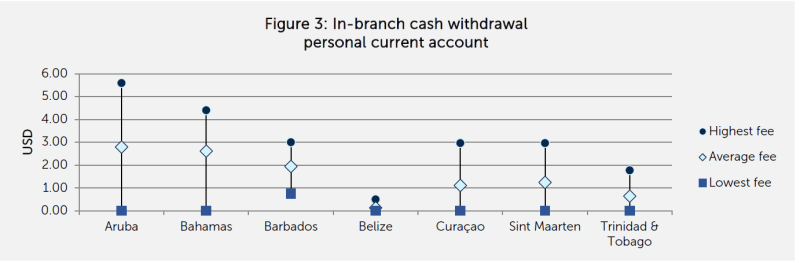

Also, for the in-branch cash withdrawal, Curaçao does not rank as the most expensive country (Figure 3).

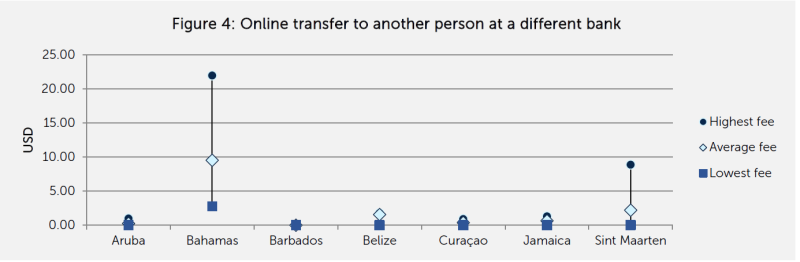

Online transfers to another person at a different bank in most countries are not imposed with charges (Figure 4). On this area Curaçao ranks between the cheapest countries.

Curaçao vs the Netherlands

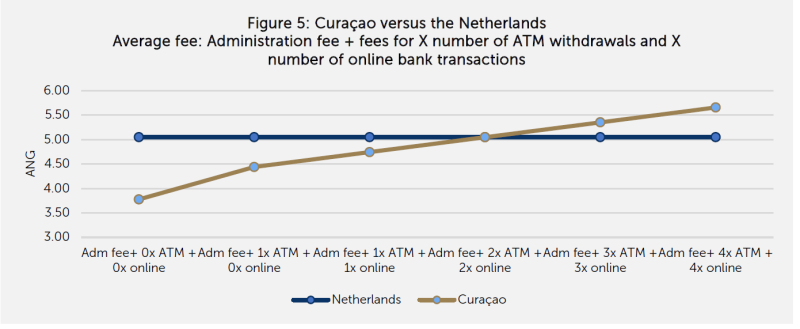

Expanding our comparative analysis to include the Netherlands, the results reveal that the average administration fee is lower compared to the Netherlands. However, administration fees in the Netherlands also include other transaction fees such as ATM withdrawals and online banking transfers. When including these other services to the administration fee for Curaçao, the results show that higher administration fees and increased transaction volumes elevate the likelihood that Curaçao becomes more expensive than the Netherlands (Figure 5). The banking fees in Curaçao cannot be compared to the Netherlands without taking into account the considerable difference in the banking landscape, size of the market, and payment infrastructure.

Figure 5 also shows example scenarios of what it would cost to maintain a personal bank account in Curaçao depending on one’s payment behavior.

Recommendations

To promote transparency, the CBCS urges commercial banks to publish the fees for the most used products and services in a standardized customer-friendly format that is easy to understand and compare.

To reduce the overall cost of banking, the CBCS encourages the use of electronic banking as much as possible. It is also recommended to lower the ATM cash withdrawals and to make use of swipe machines (POS) to make payments. Transaction costs may also be lower when conducted within the confines of one's own bank network.

Willemstad, January 10, 2024

CENTRALE BANK VAN CURAÇAO EN SINT MAARTEN

Note: The averages for each country are calculated based on the fee of all local banks within the country, except from the Netherlands; only the average fee is taken from the 5 largest banks in The Netherlands.