One of the key questions that were posed by the depositors at the meeting is if the CKC has any insurance that would safeguard the depositors. At that moment CKC and its legal advisors notified their members that the Central Bank has failed to meet the law which is stipulated under article 39 of the federal legislation that regulates the banking industry.

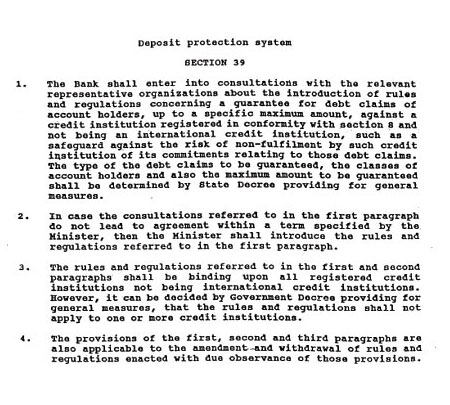

Article 39 of the bank supervison law of the central bank deposit scheme of 1994 states that the central bank has been charged with setting up of a deposit insurance scheme to protect the depositors but the Central Bank has failed to set up such an insurance. Following is article 39 of the federal legislation taken off of the Central Bank of Curacao and St. Maarten.

SMN News has been reliably informed that the CKC legal advisors are planing to file a counter suit against the Central Bank for negligence whenever they file the bankrupcy. The source said while the depositors who have over 1.7 million dollars at stake cannot file a claim towards an insurance scheme the Central Bank can be held liabable for failing to protect its deposiors. SMNNews also learnt that because there is no insurance for the banks depositors of all banks faces the risk of losing their monies since the central bank has not insured them.

SMN News has been reliably informed that the CKC legal advisors are planing to file a counter suit against the Central Bank for negligence whenever they file the bankrupcy. The source said while the depositors who have over 1.7 million dollars at stake cannot file a claim towards an insurance scheme the Central Bank can be held liabable for failing to protect its deposiors. SMNNews also learnt that because there is no insurance for the banks depositors of all banks faces the risk of losing their monies since the central bank has not insured them.