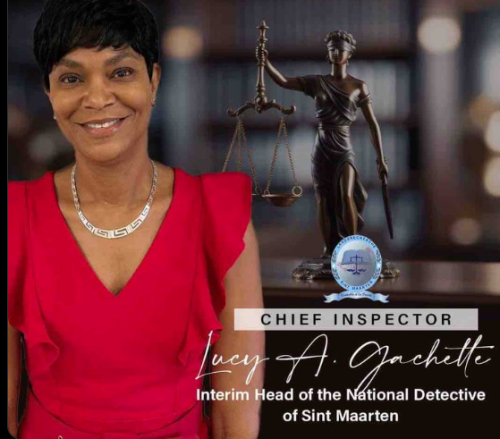

PHILIPSBURG:--- Minister of Justice Lyndon Lewis has removed the Acting Head of the Landsrecherché from her position since such a position does not exist. Even after being removed as the acting head, Gachette did not suffer any losses in terms of benefits or salaries. Chief Inspector Lucy Gachette served as Acting Head of the Landsrecherche for the past 12 years.

PHILIPSBURG:--- Minister of Justice Lyndon Lewis has removed the Acting Head of the Landsrecherché from her position since such a position does not exist. Even after being removed as the acting head, Gachette did not suffer any losses in terms of benefits or salaries. Chief Inspector Lucy Gachette served as Acting Head of the Landsrecherche for the past 12 years.

The acting head, Lucy Gachette, was informed by letter on Wednesday morning of the Minister’s decision after the Minister met with Gachette earlier this week and requested certain information that was never provided.

In an invited comment, Minister of Justice Lyndon Lewis explained that the acting head was removed from her position but remains a detective at the Landsrecherché. Lewis said the removal as head is temporary since there will be in-depth investigations into matters threatening the country's security.

Lewis further explained that the position of “head” of the Landsrecherché had opened several times, and Gachette did not apply for it.

Asked to explain what types of breaches threatened the country, the Minister said that the information had been classified; however, everyone who needed to know was officially notified. The Minister explained that more than 20 persons were present when he addressed the breaches, and the acting head lied to him.

The newly sworn-in Minister of Justice said that there has been a breach of security that threatens the country, and since taking office, he was forced to take corrective measures. Lewis made it clear that he worked within the justice chain for almost 20 years, and besides his knowledge of the Ministry, he is there to do a job and not take revenge, as many people on social media stated. "As Minister of Justice, I will be making unpopular decisions," the Minister said.

On Monday, the Minister also instructed the Chief of Police to remove Claudius Rogers from the Armed Robbery team and place him in a lower position because he was informed that Rogers told cadets in training that the Minister of Justice was corrupt.

On Monday, the Minister also instructed the Chief of Police to remove Claudius Rogers from the Armed Robbery team and place him in a lower position because he was informed that Rogers told cadets in training that the Minister of Justice was corrupt.

“I want to make clear that as the Minister of Justice, I will not allow anyone to destroy the minds of the cadets, especially about a Minister and one they do not know.”

Besides, Rogers falls under my jurisdiction, and as Minister of Justice, disciplinary measures can be taken by him.

As part of the ReCorEA project*, the non-governmental organization responsible for managing the Réserve Naturelle Nationale de Saint-Martin (the Association de Gestion de la Réserve Naturelle de Saint-Martin, or AGRNSM) is evaluating the uses, needs, and problems faced by the visitors, particularly concerning current use of mooring fields to improve them for 2024/2025. The survey ends on May 22, 2024.

As part of the ReCorEA project*, the non-governmental organization responsible for managing the Réserve Naturelle Nationale de Saint-Martin (the Association de Gestion de la Réserve Naturelle de Saint-Martin, or AGRNSM) is evaluating the uses, needs, and problems faced by the visitors, particularly concerning current use of mooring fields to improve them for 2024/2025. The survey ends on May 22, 2024.