PHILIPSBURG:--- In a stunning judicial rebuke of ministerial authority, the Court in Civil Servant Cases delivered a series of verdicts today that dismantle the government's attempts to sideline Suenah Laville-Martis, Chief of Staff to the Minister of VSA. The rulings expose a clumsy and unauthorized campaign against a civil servant, culminating in the court's annulment of a restrictive measure imposed by the Council of Ministers.

PHILIPSBURG:--- In a stunning judicial rebuke of ministerial authority, the Court in Civil Servant Cases delivered a series of verdicts today that dismantle the government's attempts to sideline Suenah Laville-Martis, Chief of Staff to the Minister of VSA. The rulings expose a clumsy and unauthorized campaign against a civil servant, culminating in the court's annulment of a restrictive measure imposed by the Council of Ministers.

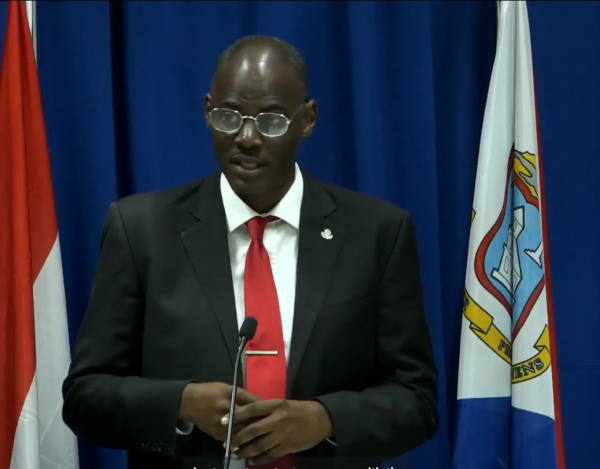

The saga began on January 7, 2026, when the Minister of General Affairs, acting as the Prime Minister, Dr. Luc Mercelina issued a sweeping "order" that barred Ms. Laville-Martis from all government buildings and ICT systems. This initial measure, prompted by an alleged verbal remark, was presented as a precursor to a formal suspension. However, the court saw it for what it was: a decision with significant legal consequences that completely undermined her ability to perform her duties.

In its first verdict, the court dealt with the appeal against this January 7th measure. While ultimately declaring the appeal inadmissible due to a lack of procedural interest, the government having already withdrawn the order—the court's preliminary assessment was damning. It dismissed the government's claim that this was a simple "work instruction." The judge clarified that denying an employee access to their workplace and tools is a formal decision affecting their legal rights, not a casual internal directive. The court also shredded the argument that the Prime Minister had the authority to issue such an order, pointing out that Article 45 of the National Ordinance on Substantive Civil Service Law (LMA) explicitly designates the Governor as the sole authority for such measures. The government's weak defense—that the Governor was informed "after the fact"—was rightfully rejected as an invalid and desperate attempt to legitimize an unauthorized action.

The affair took a more convoluted turn with the second measure, a decision made by the Council of Ministers on January 16 but only communicated to Laville-Martis a month later, on February 16. This new order, which retracted the first, imposed a bizarre and specific restriction: Laville-Martis was banned from any government building or function where the Prime Minister was present. While her access to ICT systems was restored to allow for remote work, the government essentially placed her under a geographic restraining order tied to the Prime Minister Dr. Luc Mercelina's movements.

It was this second measure that drew the court's sharpest condemnation. The government lawyers argued that the Council of Ministers is not an administrative body capable of issuing an appealable decision. The court swiftly dismantled this nonsensical argument, ruling that any decision impacting a civil servant's legal position is, by definition, an administrative act subject to judicial review, regardless of which official or body made it. The question of an entity's authority to make a decision is a matter of its legality, not its appealability.

In a decisive blow, the court declared the second access ban is null and void. The verdict was unequivocal: the Council of Ministers acted entirely outside its legal authority. Once again, the court cited Article 45 of the LMA, underscoring that only the Governor holds the power to impose such "order measures." The government’s feeble suggestion that the Governor's mere presence at the Council of Ministers meeting constituted approval was dismissed as insufficient. The court found no evidence of a formal decision by the competent authority. By taking matters into their own hands, the Council of Ministers displayed a flagrant disregard for the law.

The third and final part of the ruling logically flowed from the first two. The court denied Laville-Martis's request for a provisional measure, as the original order had been withdrawn and the second was annulled, rendering any temporary relief unnecessary. However, the court did order the Minister of General Affairs and the acting Prime Minister, Dr. Luc Mercelina, to pay Cg 1,400 in legal costs to Ms. Laville-Martis, a symbolic but significant admission of the government's costly procedural failures.

These verdicts paint a troubling picture of a government operating on personal whim rather than legal principle. Ministers appear to have acted impulsively, attempting to punish a civil servant without bothering to follow established legal channels. The repeated and failed attempts to justify these actions reveal either a profound ignorance of civil service law or a shocking arrogance. The court’s clear, logical, and scathing rulings have not only vindicated Ms. Laville-Martis but have also served as a powerful and necessary lesson in governance to the very people who are supposed to be leading the country.

Click here for the Official Decision rendered by the Administrative Court today, March 6th, 2026.

PHILIPSBURG:--- The Minister of Public Health, Social Development, and Labor, Richinel Brug, has taken note of the Ombudsman's announcement regarding the launch of a systemic investigation into the administrative practices of Social and Health Insurances (SZV), particularly as it relates to the Medical Referral Abroad program.

PHILIPSBURG:--- The Minister of Public Health, Social Development, and Labor, Richinel Brug, has taken note of the Ombudsman's announcement regarding the launch of a systemic investigation into the administrative practices of Social and Health Insurances (SZV), particularly as it relates to the Medical Referral Abroad program. PHILIPSBURG:--- The Prosecutor’s Office (OM) has officially announced the conclusion of the “Draco” case on appeal by the Joint Court of Justice. This resolution follows procedural agreements reached between the OM, suspect Silvio J. Matser, and his defense attorneys, Safira Ibrahim and Marcel van Gessel. Additionally, the related confiscation case and the “Draco 2” investigations have been resolved through financial settlements, bringing an end to all criminal and confiscation proceedings involving Matser.

PHILIPSBURG:--- The Prosecutor’s Office (OM) has officially announced the conclusion of the “Draco” case on appeal by the Joint Court of Justice. This resolution follows procedural agreements reached between the OM, suspect Silvio J. Matser, and his defense attorneys, Safira Ibrahim and Marcel van Gessel. Additionally, the related confiscation case and the “Draco 2” investigations have been resolved through financial settlements, bringing an end to all criminal and confiscation proceedings involving Matser. THE HAGUE:--- On Thursday, the Court of Appeal in The Hague overturned the conviction of a Dutch politician accused of inciting violence against the government. The court ruled that the politician's statements during a 2022 farmers' protest and a subsequent online interview did not cross the legal line into criminal incitement.

THE HAGUE:--- On Thursday, the Court of Appeal in The Hague overturned the conviction of a Dutch politician accused of inciting violence against the government. The court ruled that the politician's statements during a 2022 farmers' protest and a subsequent online interview did not cross the legal line into criminal incitement. PHILIPSBURG:--- The Council of Appeal in Civil Service Matters of Sint Maarten has affirmed the dismissal of the former director of the Bureau Telecommunicatie en Post (BTP). The decision, issued on March 4, 2026, confirms that the director (Anthony Carty) was justifiably terminated for serious dereliction of duty, specifically for failing to report secondary employment and engaging in conflicting commercial activities.

PHILIPSBURG:--- The Council of Appeal in Civil Service Matters of Sint Maarten has affirmed the dismissal of the former director of the Bureau Telecommunicatie en Post (BTP). The decision, issued on March 4, 2026, confirms that the director (Anthony Carty) was justifiably terminated for serious dereliction of duty, specifically for failing to report secondary employment and engaging in conflicting commercial activities.