This article does not professed to give the solution(s) to our current financial situation but it is intended to provoke out of the box thinking to help solve our big problem which in turn can have positive benefits in other areas of society and our economy.

To begin I want to start with the excerpt of an article I read a good while back entitled "How Did Economists Get It So Wrong?" in the New York times, published on September 2, 2009, by a gentleman called Paul Krugman who won the 2008 Nobel Memorial Prize in Economic Science. (Link: http://www.nytimes.com/2009/09/06/magazine/06Economic-t.html?_r=2&pagewanted=all

Paul gave a practical example of how a recession occurs. He states.....I like to explain the essence of Keynesian economics with a true story that also serves as a parable, a small-scale version of the messes that can afflict entire economies. Consider the travails of the Capitol Hill Baby-Sitting Co-op. This co-op, whose problems were recounted in a 1977 article in The Journal of Money, Credit and Banking, was an association of about 150 young couples who agreed to help one another by baby-sitting for one another's children when parents wanted a night out. To ensure that every couple did its fair share of baby-sitting, the co-op introduced a form of scrip: coupons made out of heavy pieces of paper, each entitling the bearer to one half-hour of sitting time. Initially, members received 20 coupons on joining and were required to return the same amount on departing the group. Unfortunately, it turned out that the co-op's members, on average, wanted to hold a reserve of more than 20 coupons, perhaps, in case they should want to go out several times in a row. As a result, relatively few people wanted to spend their scrip and go out, while many wanted to baby-sit so they could add to their hoard. But since baby-sitting opportunities arise only when someone goes out for the night, this meant that baby-sitting jobs were hard to find, which made members of the co-op even more reluctant to go out, making baby-sitting jobs even scarcer. In short, the co-op fell into a recession.

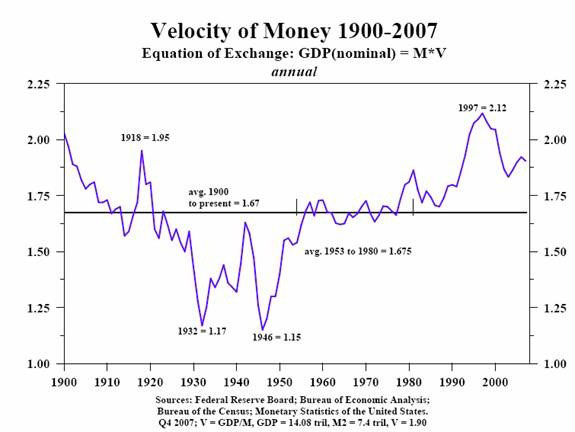

What Paul describes in his example is paramount in understanding the plausible solution that will be advocated in this article to balancing our country's budget. But before I go on to describe this solution one more ingredient needs to be explained which is called the velocity of money. In the published work done by Irving Fisher in 1912 entitled "The Purchasing Power of Money: Its Determination and Relation to Credit, Interest and Crises." Fisher employed what he called the equation of exchange to demonstrate the relationship between the quantity of money and the price level. He expressed the equation of exchange as: MV = PT where: M = Money (the average amount of money in circulation in the community during the year) V = Velocity (the average rate of turnover of money) P = Price level (the weighted average of all prices) T = Trade (the volume of trade). The statement MV = PT must always be true, given the preceding definitions for M, V, P, and T. Essentially, it means the amount spent (MV) is always equal to price of all the things bought (PT) for any particular community during any given period of time. MV is the quantity of money (M) multiplied by the number of times that money is used during the period (V). PT represents the price (P) of each product multiplied by the quantity purchased or the volume of trade (T). Fisher explained it as follows: In each sale and purchase, the money and goods exchanged are ipso facto equivalent; for instance, the money paid for sugar is equivalent to the sugar bought. And in the grand total of all exchanges for a year, the total money paid is equal in value to the total value of the goods bought. The equation thus has a money side (the left side of the equation) and a goods side (the right side of the equation). The money side is the total money paid, and may be considered as the product of the quantity of money multiplied by its rapidity of circulation. The goods side is made up of the products of quantities of goods exchanged multiplied by their respective prices. It is important to point out that the right side of the equation, PT, is equivalent to total economic output. It represents the price level multiplied by the volume of trade, or, in other words, the value of everything produced and sold by a community during a certain period of time. The value of all goods produced and sold by a country during one year is that country's gross domestic product, or GDP. Therefore, MV = PT = GDP. Of course today, M is equivalent to Credit therefore the formula today should be CV = PT but that is another topic for discussion.

What Paul describes in his example is paramount in understanding the plausible solution that will be advocated in this article to balancing our country's budget. But before I go on to describe this solution one more ingredient needs to be explained which is called the velocity of money. In the published work done by Irving Fisher in 1912 entitled "The Purchasing Power of Money: Its Determination and Relation to Credit, Interest and Crises." Fisher employed what he called the equation of exchange to demonstrate the relationship between the quantity of money and the price level. He expressed the equation of exchange as: MV = PT where: M = Money (the average amount of money in circulation in the community during the year) V = Velocity (the average rate of turnover of money) P = Price level (the weighted average of all prices) T = Trade (the volume of trade). The statement MV = PT must always be true, given the preceding definitions for M, V, P, and T. Essentially, it means the amount spent (MV) is always equal to price of all the things bought (PT) for any particular community during any given period of time. MV is the quantity of money (M) multiplied by the number of times that money is used during the period (V). PT represents the price (P) of each product multiplied by the quantity purchased or the volume of trade (T). Fisher explained it as follows: In each sale and purchase, the money and goods exchanged are ipso facto equivalent; for instance, the money paid for sugar is equivalent to the sugar bought. And in the grand total of all exchanges for a year, the total money paid is equal in value to the total value of the goods bought. The equation thus has a money side (the left side of the equation) and a goods side (the right side of the equation). The money side is the total money paid, and may be considered as the product of the quantity of money multiplied by its rapidity of circulation. The goods side is made up of the products of quantities of goods exchanged multiplied by their respective prices. It is important to point out that the right side of the equation, PT, is equivalent to total economic output. It represents the price level multiplied by the volume of trade, or, in other words, the value of everything produced and sold by a community during a certain period of time. The value of all goods produced and sold by a country during one year is that country's gross domestic product, or GDP. Therefore, MV = PT = GDP. Of course today, M is equivalent to Credit therefore the formula today should be CV = PT but that is another topic for discussion.

Now why is the velocity of money so important to grasp together with the example of the Capitol Hill Baby-Sitting Co-op? See below chart and stay tuned for part 2 to find out.

Emilio Kalmera