Marigot:--- Union for Democracy issues today the report from its Commission on finances and fiscality which was presented to the Executive Board of UD last Monday. The Commission is headed by Mr Jacques Hamon, retired accountant and business man. Six other persons, all linked to this sector of activity, have been part of the work.

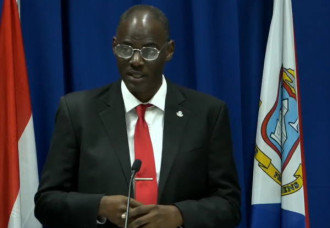

Daniel Gibbs, president of UD said: « We know that the credibility towards the administration is very low among our fellow citizens. We must give them back the confidence in our institutions. That is why we are determined to put in place an effective, efficient and fair tax system over a 100 days period.»

We publish the Report as it is.

No Government, regardless of its size or budget, can work in a sound and coherent way without a clear and effective taxation system.

When we were a Commune, the taxation system was clear since it could not differ from the framework set by French laws. When Saint-Martin entered its new status as an overseas territorial Collectivité in 2007, it then became custodian of one of the most important tools regarding public policies: taxation. But we must acknowledge that this tool was either poorly utilized or not utilized at all in certain instances. It is a pity that policy makers have not wanted or known how to take advantage of such an incredible opportunity as the ability to establish the Collectivité’s own taxation.

Over the past 5 years we have been locked in an "ad nauseam" argument with the State regarding: "who owes what to whom." Unfortunate misunderstandings in public disputes leave us at a standstill. The President of the Collectivité was so slow to undertake legal proceedings that it would be surprising to have a decision from the courts before March 2012 territorial elections. Worse than this dead end towards which Saint-Martin is heading, is the irrational taxation policy that the Collectivité has set up, a sort of inconceivable patchwork. In short, the opposite of clarity, efficiency and justice!

Some today claim to provide solutions. They forget that they were the ones who led us in this blind alley! How can they claim today to want to put in place an efficient and competitive taxation system while in June 2011 they refused a proposal from D. Gibbs to create an ad - hoc Commission? How can others, claim to lead the way regarding a renewed tax system while a year ago, they were either silent or opposed to a serious study of the entire tax structure? Let the People be the Judge.

PREMIS

There will be no effective tax structure, as detailed as it may be, if the economy is in shambles. In Saint-Martin, our primary source of income is tourism. This sector, partly because of the international crisis, but also because of the indecisiveness of the Collectivité for the past three years, is in decline. Our infrastructure is not to the minimum level required to attract even the tourists who would want to come. Our attractiveness, set aside our beaches, offers nothing unique compared to the rest of the Caribbean. Everywhere, surrounding States or Islands, are actively developing original tourism products to reach niche markets that will “make a difference." The Dutch side has developed its appeal by following a plan which led to the building of the Boardwalk, of the Cruise facility, timeshare etc…

If we do not undertake one or several major, development projects, which will attract new tourists and additional income for the Collectivité, merchants, other professionals and for Construction Companies, it is useless to talk about taxation: No income, no taxpayers!

For these key reasons the UD emphasizes on large scale economic development projects. Those who will exhibit tables of figures of any kind to explain their solution on taxation, without real development projects –or projects based exclusively on public money as it is usually the case in Saint-Martin - will show the emptiness of their ideas.

OUR APPROACH

The UD approach has not changed since June 2010 when Daniel Gibbs presented a deliberation to the territorial Council. Only experts, because there are different trends of thought on taxation, not one but several experts, can enlighten us whether normal citizens or elected representatives. But with appropriate information, it will be for elected representatives to make their choice. Every action carries consequences. We have been improvising for too long and the consequences have been serious for Saint-Martin.

We will not, in spite of promises made by others during the election campaign, engage in unchartered course or make decisions without prior discussions based on very specific ANALYSES. Those who sell dreams will say many things. Before making a decision it is necessary to gather information and then to analyze all the possibilities.

Taxation in Saint-Martin must no longer pop out as a surprise from a bag!

TAXE STIMULUS

CONTEXT:

I Objectives of Tax and taxation system upgrade

- To establish a simple, fair and effective tax system with a high collection rate

- To establish a stable source of income to finance the Collectivité of Saint-Martin and the socio-economic projects it will develop

- To lighten the tax burden of physical and legal persons residing on the island

- To stimulate local and foreign investments and obtain a high and rapid collection rate

II Constraints

We must set reasonable taxes that are acceptable to the tax payer, less penalizing for the economy and for the obligations of the Collectivité to its nationals.

The system must take into consideration the specificities of the island:

Positive Points:

- Privileged destination for tourist coming, essentially, from two continents, Europe and America

-Increasing number of facilities: airports (1 international and 1 local) and ports (1 international trade, 1 local)

- Strong potential for (Hotels, activities, untouched markets,...)

-Advantage related to the dual currency and dual language

-Youth of the population

Negative points

-Limited natural resources and industries

-High cost of production of water, electricity, energy,...

- Poor habits regarding tax contributions

- Fiscal evasion on neighbor territories

- Rate change between the two currencies.

III Option

We present here the three possibilities the experts value as experienced.

Our today system:

To levy taxes on revenues, assets and turn over generated by residents or nationals on the territory as foreseen in the General Taxation code of 2007, amended by severail Island Council deliberations.

Particular system: (so called Caricom)

This system has been used in the Caricom and elsewhere, where taxes are levied on those who will use the facilities and resources of the territory: thus the tourist. This can be achieved by creating poles of exceptional interest over competitors and focusing on quality tourism by offering them on St-Martin what they cannot find elsewhere. Hence the importance of always ensuring : Accomodation/ Competence/ Facilities and security. This system needs, to be effective, a strong and healthy financial base for the involved actors as well as a habit of partnership with the COM.

. The alternative we privilege:

Restructuration of the actual system in order to give the COM a taxation code adapted to our specificities, especially the fact that we are on a small territory. This system has to respond to the three following rules:

. Incentive: abolition of all taxes harming investment and labor .

. Effective: widening of the fiscal assets through simple declarations

. Fair: harmonization of indirect fiscality by a tax on business sales with modulated tariffs based on the nature of goods and services (first necessity, normal, luxury etc..)

This system also needs a new approach on the negotiations with the State.

2 ACTION

1ST Stage ( day 0 to 30-60days) Assessment of the existing situation and needs

-Description of the present situation

-Evaluation of activities and potential taxation areas:

-Turnover generated on the island –

-Real estate Value

-Sales of specific items such as; cigarettes and gasoline –

-Hotels and tourism –

Investment of the State on the island (social benefits, RMI,...)-etc.

Evaluation of the budgetary needs of the COM:

- Operations

- Education and training

- Departments involved in economic promotion

- Mean dedicated to social projects

Capital Investment

Debt servicing

Non governmental Services benefiting from taxation: Chamber of commerce, tourism, EPIC… -

Concept of subsistence of the population

*Listing and assessment of the means and jurisdiction regarding taxation at our disposal

* Legal Aspects related to taxation, transition and authority of Collectivité

2nd stage: Identifying various taxes and their impacts (0 + 90 days)

*analysis of taxes and their consequences on various sectors of our society;

*Recommendations

*Collection means, including:

training

human resources

technology

control methods

*effects and means of mitigating difficulties due to dual nationality on the island and the problems resulting from "the evasion" of our resources on the side Dutch.

Evaluation of the impact of taxes allocated to of EPIC, Chamber of Commerce or other

Improvement opportunities of the proposed means; amendment and adaptation

Necessary legal adjustments, if any.

implementation period

3Rd step: Report and vote by the Territorial Council (day 100)