Advice deviates from government proposals on important issues

Advice deviates from government proposals on important issues

PHILPSBURG----The much anticipated SER advice entitled "The AOV system made Affordable, Sustainable and Equitable" is now available to the general public. This advice pertains to a policy plan drafted by the government's Steering group on pension reform. The policy paper dealt with proposed measures to reform Sint Maarten's AOV entitlement system, and ensure the financial health of the AOV fund in the long run. In their advice, the SER deviates on important points from the government proposals and formulates alternative recommendations of their own. The document is now available on the SER website www.sersxm.org. All components of the advice mentioned below were approved unanimously by the nine SER members, comprised of representatives from the labour unions, the business community and independent experts.

The need for AOV reform is caused on the one hand by the difference between the original Netherlands Antilles population composition and the Sint Maarten situation. This causes the premium percentages to be high in the context of our relatively young population, causing the premiums collected to be higher. At the same time, many aspects of the AOV system are outdated, such as the amount of the entitlement, and the pension age. Finally, all measures together need to add up to a sustainable and financially sound AOV fund. The SER recommendations are based on the same points of departure and methods of calculation used by the government's steering group.

Increase the AOV benefit to Naf 1,000

The SER supports the government intention, already implemented, to raise the monthly AOV benefit to Naf. 1,000. Although this is a level still below the minimum wage, it is a necessary step, long overdue, to bring the AOV closer to a level sufficient to allow for basic subsistence.

Premium to be levied on all income up to 100,000

Currently AOV premium is calculated over income up to Naf 80,336 annually. This amount needs to be corrected for inflation periodically, and is now raised to Naf. 100,000. The SER supports this government intention. It needs to be said that nobody will actually pay more premium according to the SER proposal, for the SER – contrary to government - also recommends a reduction of the premium percentages.

SER: reduce premium percentage with 1.5% for both employees and employers

Currently employers pay 7% AOV premium while employees pay 6% over the workers' wages. These are very high percentages, stemming from the relatively 'old' population composition of the Netherlands Antilles. The government proposals however do not include any reduction of premium percentages. The SER on the other hand advises to lower the premium percentages to reflect the younger Sint Maarten population. Employer contribution should be reduced from 7 to 5.5 percent, while employees should pay 4.5 instead of 6 percent. This means an instant reduction in wage costs for all businesses of almost 1.5%, and an immediate increase in purchasing power for all wage earners of around 1.5% as well.

Keep AOV affordable in the long run by gradually raising AOV age

The SER agrees with government in gradually increase AOV age from 60 to 62 over the course of the years. This follows international trends, as there is hardly any country in the world with a state pension starting at 60, even 62 is comparatively low. This measure cuts both ways: workers will pay into the AOV system for more years, while the number of years of AOV entitlement is reduced. However, after having increases the entitlement age to 62, in approximately 2017, the SER advises to gradually go on increasing the AOV age to 65. This will ensure long-term sustainability of the AOV fund and take away the need to increase premium percentages again.

Full AOV after 10 or more active years on Sint Maarten

Government intends to maintain the present law, stipulating that only people who have lived in the Antilles or Sint Maarten for 45 years, from age 15 to age 60, will receive full AOV. With less than 45 years in the Antilles, a retiree receives proportionally less AOV. The SER does not consider this justifiable however, as we have many immigrants in Sint Maarten who chose to make the island their permanent home and contributed to our economic development, and who are at a disadvantage once they retire, because they did not live in Sint Maarten for the first part of their life. The SER recommends granting anyone who has ten or more years of active career on Sint Maarten, full AOV, reduced of course by entitlements the person may get from an earlier country of residence.

Additional pension plan necessary

Next to AOV, a lot of work needs to be done in the field of additional pension plans. Only 36% of the Sint Maarten working population has a pension plan additional to AOV. The other 64% will have to rely on their savings or on private life insurance they have taken out on their own initiative to ensure a comfortable old age. Factors that contribute to this situation are the lack of employment based pension plans, combined with the absence of tax deduction for private pension insurance.

Make private pension plans (lijfrente) tax deductible up to Naf. 12,000 annually

The great majority of workers lack any supplementary pension plan above AOV, it is therefore recommendable to take out private pension insurance (known in Dutch as lijfrente). The premiums involved are tax deductible in most countries, on the same footing as pension premiums. However in Sint Maarten only Naf. 1,000 is deductible annually, which is an insignificant sum for this purpose. Government rejected initial proposals to increase the tax deductibility to Naf. 12,000 a year. The SER however does advise to increase the private pension premium tax deduction to Naf 12,000.

Follow up with general supplementary pension arrangement

The SER fully supports the government intention to follow up the AOV reforms with research into a general employment based pension scheme supplemental to AOV, taking into account the very low coverage of workers under such pension plans. The recently introduced general pension scheme in Aruba may serve as an example to this effect.

SER proposals more equitable, yet ensure financial durability

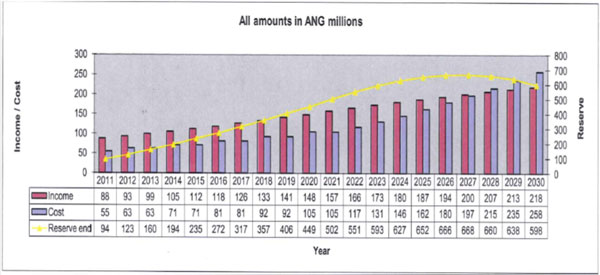

Compared to the government proposals, the AOV reform advised by the SER adds some equitable and economically justified points, while still ensuring financial durability of the AOV system in the long run, as the graph below illustrates.

The current surplus situation, in which premiums collected are higher than AOV paid out, will last until 2027 at least. The AOV fund reserves will therefore keep growing until that year, topping off at more than Naf. 600 million, only to decrease slowly over the decade after that.

In conclusion, the SER advice ensures financial durability, meanwhile – contrary to government proposals - lowering AOV premiums for employers and employees alike and granting long settled immigrants full AOV.

Click here to view the full SER advice on AOV Reform.