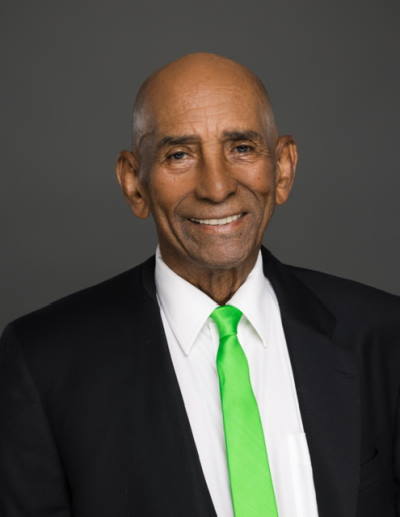

PHILIPSBURG:--- The controversial ENNIA Insurance bailout agreement has sparked significant debate among the Governments of Curacao and St. Maarten. The proposed deal is at the heart of this contention, which could burden St. Maarten taxpayers with millions of dollars in costs over the next fifty years. Attorney at Law, former Minister of Finance, and ex-ENNIA employee Richard Gibson Sr. have provided a detailed analysis of the situation, raising critical concerns about the agreement's implications for St. Maarten.

PHILIPSBURG:--- The controversial ENNIA Insurance bailout agreement has sparked significant debate among the Governments of Curacao and St. Maarten. The proposed deal is at the heart of this contention, which could burden St. Maarten taxpayers with millions of dollars in costs over the next fifty years. Attorney at Law, former Minister of Finance, and ex-ENNIA employee Richard Gibson Sr. have provided a detailed analysis of the situation, raising critical concerns about the agreement's implications for St. Maarten.

Gibson Sr. has emerged from retirement to address what he perceives as a hasty and ill-considered decision by Former Prime Minister and Minister of Finance. Gibson asserts that the bailout agreement was signed without consulting or seeking approval from the Parliament of St. Maarten.

As Gibson highlights, one of the most troubling aspects of the agreement is its timing. The deal was signed just days before the January 11, 2024, Parliamentary Election, raising suspicions about the urgency and transparency of the process. Gibson questions why such a significant financial commitment was made without parliamentary consent, which he insists was required and prudent.

"The agreement signed cannot go forward without the approval of Parliament, which the former Minister of Finance knew," Gibson stated. He emphasized that this procedural misstep not only undermines democratic processes but also jeopardizes the financial stability of St. Maarten. Gibson's analysis underscores a critical imbalance in the benefits derived from the bailout. ENNIA, a Curacao-based company, pays taxes and primarily operates in Curacao, with 95% of its employees residing there. This means that most of the economic activities and benefits associated with the company will remain in Curacao. In stark contrast, St. Maarten, with only 3,000 of ENNIA's 30,000 policyholders, needs to gain more from the proposed financial support.

"Investing in a Company in another country could be a good idea, but only if you get a fair return on your investment," Gibson remarked. He advocates for a more balanced approach where St. Maarten's contribution to the bailout would also secure an interest in ENNIA, ensuring potential returns for the island if the company performs well. Gibson firmly believes that St. Maarten's 3,000 policyholders should be safeguarded, but not at the taxpayers' expense. He suggests alternative methods to protect local policyholders without committing St. Maarten to an unfavorable financial agreement for the next 50 years.

"The Curacao 27,000 policyholders should be taken care of by Curacao, and St. Maarten should take care of its 3,000 policyholders," Gibson proposed. He insists that any financial support should be contingent on receiving equitable benefits, thereby ensuring that the interests of St. Maarten are adequately protected.

Given these concerns, Gibson calls on the Parliament of St. Maarten to be critical when considering the current agreement. He emphasizes the need for a more transparent and mutually beneficial arrangement that prioritizes St. Maarten's and its taxpayers' interests.

"Sending all this money to Curacao to support a Curacao company that we do not own any shares in is a bad idea and should be rejected. “The agreement should never have been signed, but I hope the Parliament of St. Maarten rejects it out of hand."

Gibson's critique highlights the need for careful consideration and due diligence in governmental financial commitments, particularly those with long-term implications. As the debate continues, the people of St. Maarten await the Parliament's decision on this contentious issue, hoping for a resolution that protects their economic future and ensures fair treatment for all stakeholders.