PHILIPSBURG:--- During the draft 2025 budget debate on Thursday, Member of Parliament Egbert Jurendy Doran delivered a compelling address in Parliament, sharply criticizing the government’s approach to transparency and readiness regarding the proposed Dividend Withholding Tax. Doran not only highlighted critical issues surrounding the new tax but also presented a motion calling for a suspension of its implementation until key requirements for analysis and stakeholder engagement are met. The motion underscores Doran’s dedication to ensuring responsible governance and protecting the interests of St. Maarten’s citizens and businesses.

PHILIPSBURG:--- During the draft 2025 budget debate on Thursday, Member of Parliament Egbert Jurendy Doran delivered a compelling address in Parliament, sharply criticizing the government’s approach to transparency and readiness regarding the proposed Dividend Withholding Tax. Doran not only highlighted critical issues surrounding the new tax but also presented a motion calling for a suspension of its implementation until key requirements for analysis and stakeholder engagement are met. The motion underscores Doran’s dedication to ensuring responsible governance and protecting the interests of St. Maarten’s citizens and businesses.

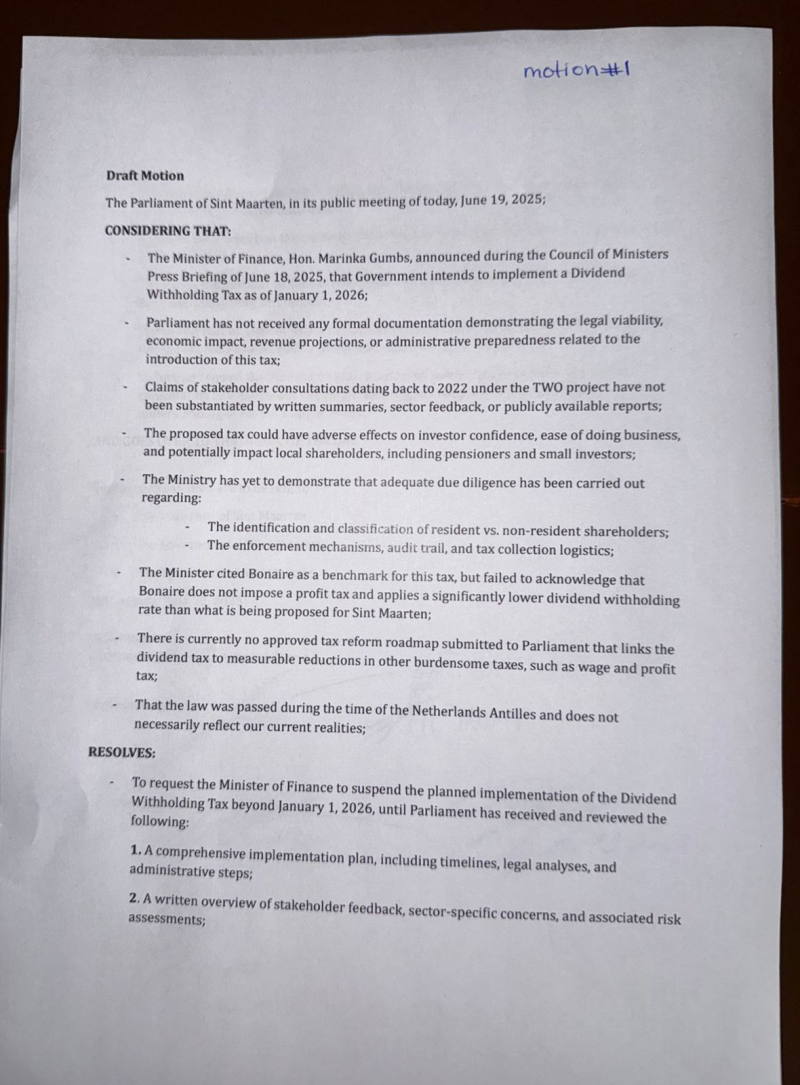

A Call for Transparency and Documentation

MP Doran’s primary concern was the lack of thorough preparation and transparency surrounding the Dividend Withholding Tax, slated to take effect on January 1, 2026. According to Doran, the government failed to provide Parliament with vital documents demonstrating the tax’s legal and economic implications, revenue projections, and administrative preparedness.

“Parliament has not received any formal documentation demonstrating the legal viability, economic impact, revenue projections, or administrative preparedness related to the introduction of this tax,” Doran stated firmly. He criticized the government’s reliance on broad claims, particularly regarding stakeholder consultations dating back to 2022, which, he pointed out, have not been substantiated with summaries or public reports.

Critique of Stakeholder Engagement and Readiness

A significant part of Doran’s address focused on the inadequacy of stakeholder engagement and the government’s apparent unpreparedness to implement the tax effectively. He questioned whether key sectors, such as real estate, tourism, and finance, had been consulted and expressed concern about the lack of an economic impact assessment.

“How can we move forward with such a fundamental policy change without understanding its full impact on investors, local businesses, and the broader economy?” Doran queried. He also raised doubts about the readiness of the tax office to enforce and monitor the new tax regime, stressing that the current system is already under strain.

The Bonaire Comparison and Governance Concerns

Another central theme of Doran’s critique was the government’s use of Bonaire as a benchmark for the proposed tax, a comparison he argued was flawed. “The Bonaire system does not impose profit tax and applies a significantly lower dividend withholding rate,” Doran noted, emphasizing that the realities of St. Maarten’s economy differ vastly.

He further expressed frustration with what he described as “an unprecedented lack of access to critical information,” lamenting the use of confidentiality and non-disclosure agreements as barriers to transparency. According to Doran, representatives in Parliament cannot fulfill their duties to the people if they are denied access to relevant documents.

Key Points of the Motion

The motion presented by MP Doran during the session outlined several critical steps necessary to ensure responsible governance surrounding the Dividend Withholding Tax. Its key components include:

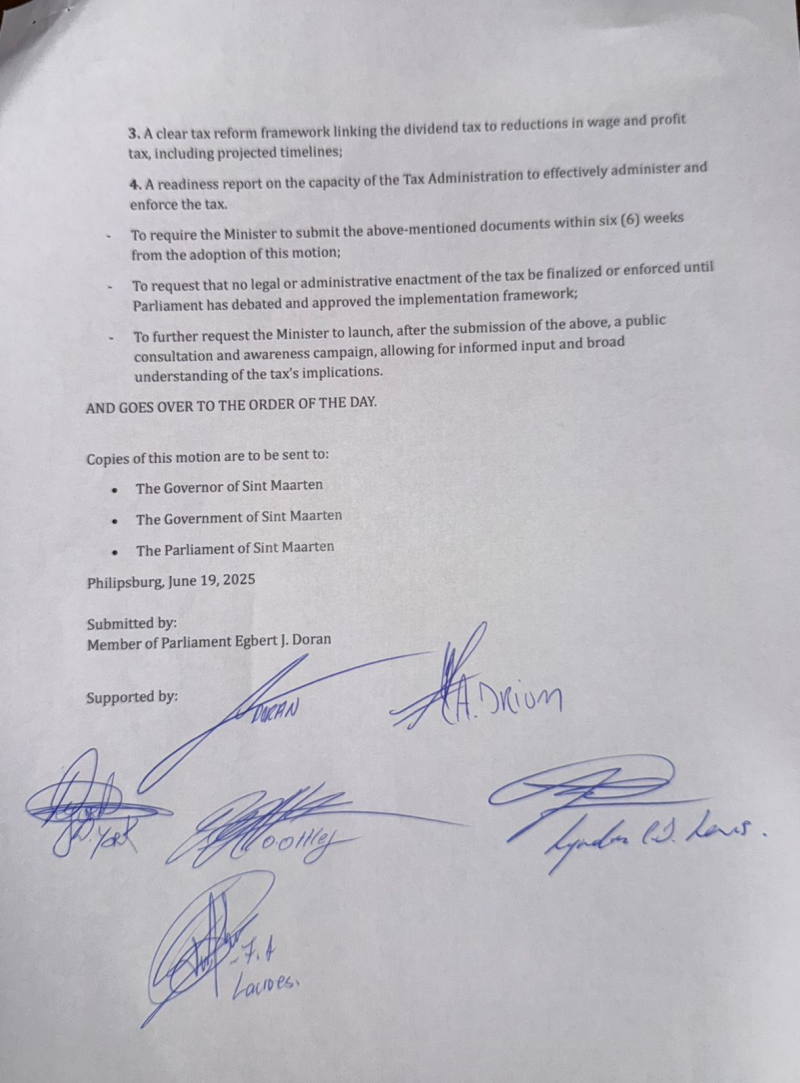

- Suspension of Implementation: The motion urges the government to suspend the introduction of the tax until Parliament has reviewed crucial documents, including a comprehensive implementation plan and a tax reform framework.

- Stakeholder Engagement and Risk Assessment: This involves a detailed overview of consultations with stakeholders and an analysis of associated risks to key sectors of the economy.

- Administrative Preparedness: The motion requests a readiness report from the Tax Administration, demonstrating that it has the staffing, technical systems, and capacity to enforce and monitor the tax.

- Public Awareness Campaigns: Recognizing the importance of clarity and communication, the motion requests a public consultation and awareness campaign to educate the population and business sector about the tax’s implications.

- Parliamentary Oversight: To safeguard transparency, the motion stipulates that no legal or administrative action regarding the tax should proceed until Parliament has debated and approved its implementation framework.

- The motion was co-signed by MPs Yark, Irion, and Hartley, reflecting broader support for stronger accountability measures in financial policymaking.

- Vision for Accountable Governance

- MP Egbert Jurendy Doran’s address and motion underline his commitment to transparent and responsible governance. “The people of St. Maarten deserve clear answers and a government that prioritizes their interests over short-term gains,” Doran declared, urging Parliament and the Council of Ministers to take a more thorough and inclusive approach to policy implementation.

- Through his motion, Doran highlighted the need for due diligence and stressed the significance of aligning policies with the realities of St. Maarten’s economy. His stance resonated as a powerful call for better governance practices and a reminder of Parliament’s critical role in protecting the interests of its citizens.

- The Road Ahead

- With the draft 2025 budget debate ongoing, the motion introduced by MP Doran represents a crucial step toward accountability in St. Maarten’s fiscal policies. Whether the government acts upon these recommendations will determine the country’s path forward, either toward greater transparency and economic stability or deeper concerns about uncoordinated policymaking.

- MP Doran left no doubt as to his intention to uphold his duty to the people, concluding his address with a firm commitment to continue advocating for clarity, fairness, and responsible governance in Parliament.