PHILIPSBURG:--- The Sint Maarten Science Fair Foundation (SMSFF) is pleased to announce the official launch of Science Week 2026, which will kick off with an Opening Ceremony and panel discussion on Monday, March 9, 2026, at the Hills Event Hall, from 6:00 PM to 8:00 PM.

PHILIPSBURG:--- The Sint Maarten Science Fair Foundation (SMSFF) is pleased to announce the official launch of Science Week 2026, which will kick off with an Opening Ceremony and panel discussion on Monday, March 9, 2026, at the Hills Event Hall, from 6:00 PM to 8:00 PM.

Science Week is a national initiative designed to stimulate youth engagement in science, technology, and innovation. Science Week 2026 is held under the theme “Innovate for Wellbeing”, with the subtheme “Moving Ideas to Solutions.” The opening ceremony will set the tone for a week dedicated to exploring how science, technology, engineering, arts, and mathematics (STEAM) can drive meaningful solutions that enhance individual and community well-being.

The opening evening will feature a regional address by Mr. Keeghan Patrick (virtual), followed by a moderated panel discussion by Ife Badejo, bringing together local professionals from technology, innovation, psychology, entrepreneurship, and health. Panelists include Mrs. Vincentia Rosen-Sandiford, Mr. Michael Jeffrey, Ms. Ipek Uysal, Ms. Emmalexis Velasquez, and Mrs. Eva Lista-De Weever. The discussion will explore how innovation, applied science, and emerging technologies can be translated into practical solutions that improve lives, strengthen communities, and support overall well-being. Attendees can expect an engaging and thought-provoking exchange of ideas, real-world experiences, and forward-looking perspectives aligned with the Science Week 2026 theme. Members of the public, educators, students, professionals, and partners are encouraged to register in advance to attend the Science Week 2026 Opening Ceremony via http://tinyurl.com/SW2026Opening or contact us at +1721-588-9650.

Other public events taking place during Science Week 2026 include the Annual St. Maarten Science Fair, showcasing student projects and STEAM demonstrations.

The general public is invited to two viewing sessions at the Aleeze Convention Center:

● Thursday, March 12, 2026: 5:30 PM - 7:00 PM

● Friday, March 13, 2026: 12:00 noon - 2:00 PM (Featuring the Anguilla Robotics Association & ANIS St. Martin)

For a full schedule of events, including dedicated school events, please visit the SMSFF Facebook page at https://www.facebook.com/SXMSCIENCEFAIR/.

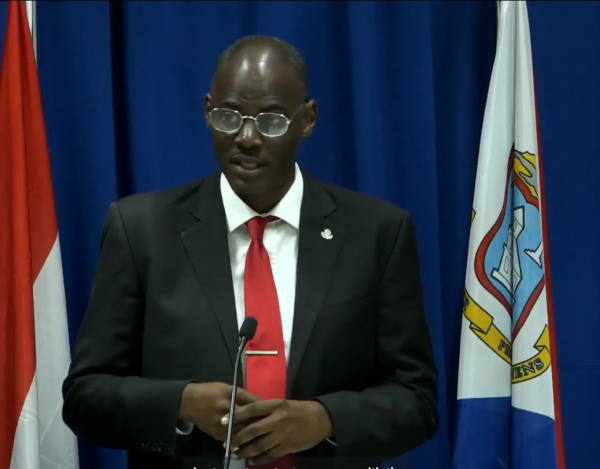

Prime Minister Dr. Luc Mercelina Honors Women of Sint Maarten on International Women’s Day 2026.

PHILIPSBURG:--- On the occasion of International Women’s Day 2026, the Honorable Prime Minister of Sint Maarten, Dr. Luc Mercelina, extends sincere appreciation and recognition to the women of Sint Maarten and around the world whose leadership, resilience, and dedication continue to shape stronger families, communities, and nations.

PHILIPSBURG:--- On the occasion of International Women’s Day 2026, the Honorable Prime Minister of Sint Maarten, Dr. Luc Mercelina, extends sincere appreciation and recognition to the women of Sint Maarten and around the world whose leadership, resilience, and dedication continue to shape stronger families, communities, and nations.

This year’s International Women’s Day theme, “Give to Gain,” highlights the importance of investing in women and girls, recognizing that when society gives support, opportunity, and empowerment to women, the entire community gains progress, prosperity, and resilience.

Prime Minister Dr. Mercelina emphasized that the women of Sint Maarten have long played an essential role in the country’s social and economic development.

“International Women’s Day is an opportunity to celebrate the remarkable women of Sint Maarten who contribute daily to the growth and well-being of our nation. From our educators and healthcare professionals to entrepreneurs, civil servants, and community leaders, women continue to give their time, talent, and dedication to building a stronger Sint Maarten.”

The Prime Minister noted that the theme “Give to Gain” reflects a simple but powerful truth: empowering women strengthens the entire society.

“When we give women the tools to succeed through education, leadership opportunities, and economic empowerment, we gain stronger families, healthier communities, and a more prosperous nation.”

PM Dr. Mercelina also acknowledged the countless women whose efforts often take place quietly but whose contributions remain invaluable to the country’s development.

“Across Sint Maarten, women continue to inspire through their perseverance, compassion, and commitment to service. Their contributions remind us that nation-building is strengthened by the dedication of women who lead, mentor, and uplift others.”

The Prime Minister encouraged the community to use International Women’s Day as both a celebration and a renewed commitment to advancing equality and opportunity.

“Let us continue to give our support, our respect, and our opportunities to the women and girls of Sint Maarten. In doing so, we will gain a more inclusive, resilient, and prosperous future for our entire nation.”

Prime Minister Mercelina concluded by thanking the women of Sint Maarten for their ongoing contributions to the country’s development and progress.

“To every woman and girl in Sint Maarten, your strength, your leadership, and your contributions are deeply valued. Today we celebrate you, and we reaffirm our commitment to building a society where your potential can fully flourish.”

Government Overreach Crushed in Court as Judge Rules Against Ministers in Laville-Martis Case.

PHILIPSBURG:--- In a stunning judicial rebuke of ministerial authority, the Court in Civil Servant Cases delivered a series of verdicts today that dismantle the government's attempts to sideline Suenah Laville-Martis, Chief of Staff to the Minister of VSA. The rulings expose a clumsy and unauthorized campaign against a civil servant, culminating in the court's annulment of a restrictive measure imposed by the Council of Ministers.

PHILIPSBURG:--- In a stunning judicial rebuke of ministerial authority, the Court in Civil Servant Cases delivered a series of verdicts today that dismantle the government's attempts to sideline Suenah Laville-Martis, Chief of Staff to the Minister of VSA. The rulings expose a clumsy and unauthorized campaign against a civil servant, culminating in the court's annulment of a restrictive measure imposed by the Council of Ministers.

The saga began on January 7, 2026, when the Minister of General Affairs, acting as the Prime Minister, Dr. Luc Mercelina issued a sweeping "order" that barred Ms. Laville-Martis from all government buildings and ICT systems. This initial measure, prompted by an alleged verbal remark, was presented as a precursor to a formal suspension. However, the court saw it for what it was: a decision with significant legal consequences that completely undermined her ability to perform her duties.

In its first verdict, the court dealt with the appeal against this January 7th measure. While ultimately declaring the appeal inadmissible due to a lack of procedural interest, the government having already withdrawn the order—the court's preliminary assessment was damning. It dismissed the government's claim that this was a simple "work instruction." The judge clarified that denying an employee access to their workplace and tools is a formal decision affecting their legal rights, not a casual internal directive. The court also shredded the argument that the Prime Minister had the authority to issue such an order, pointing out that Article 45 of the National Ordinance on Substantive Civil Service Law (LMA) explicitly designates the Governor as the sole authority for such measures. The government's weak defense—that the Governor was informed "after the fact"—was rightfully rejected as an invalid and desperate attempt to legitimize an unauthorized action.

The affair took a more convoluted turn with the second measure, a decision made by the Council of Ministers on January 16 but only communicated to Laville-Martis a month later, on February 16. This new order, which retracted the first, imposed a bizarre and specific restriction: Laville-Martis was banned from any government building or function where the Prime Minister was present. While her access to ICT systems was restored to allow for remote work, the government essentially placed her under a geographic restraining order tied to the Prime Minister Dr. Luc Mercelina's movements.

It was this second measure that drew the court's sharpest condemnation. The government lawyers argued that the Council of Ministers is not an administrative body capable of issuing an appealable decision. The court swiftly dismantled this nonsensical argument, ruling that any decision impacting a civil servant's legal position is, by definition, an administrative act subject to judicial review, regardless of which official or body made it. The question of an entity's authority to make a decision is a matter of its legality, not its appealability.

In a decisive blow, the court declared the second access ban is null and void. The verdict was unequivocal: the Council of Ministers acted entirely outside its legal authority. Once again, the court cited Article 45 of the LMA, underscoring that only the Governor holds the power to impose such "order measures." The government’s feeble suggestion that the Governor's mere presence at the Council of Ministers meeting constituted approval was dismissed as insufficient. The court found no evidence of a formal decision by the competent authority. By taking matters into their own hands, the Council of Ministers displayed a flagrant disregard for the law.

The third and final part of the ruling logically flowed from the first two. The court denied Laville-Martis's request for a provisional measure, as the original order had been withdrawn and the second was annulled, rendering any temporary relief unnecessary. However, the court did order the Minister of General Affairs and the acting Prime Minister, Dr. Luc Mercelina, to pay Cg 1,400 in legal costs to Ms. Laville-Martis, a symbolic but significant admission of the government's costly procedural failures.

These verdicts paint a troubling picture of a government operating on personal whim rather than legal principle. Ministers appear to have acted impulsively, attempting to punish a civil servant without bothering to follow established legal channels. The repeated and failed attempts to justify these actions reveal either a profound ignorance of civil service law or a shocking arrogance. The court’s clear, logical, and scathing rulings have not only vindicated Ms. Laville-Martis but have also served as a powerful and necessary lesson in governance to the very people who are supposed to be leading the country.

Click here for the Official Decision rendered by the Administrative Court today, March 6th, 2026.

Minister Brug Responds to Ombudsman Investigation into SZV Administrative Practices

PHILIPSBURG:--- The Minister of Public Health, Social Development, and Labor, Richinel Brug, has taken note of the Ombudsman's announcement regarding the launch of a systemic investigation into the administrative practices of Social and Health Insurances (SZV), particularly as it relates to the Medical Referral Abroad program.

PHILIPSBURG:--- The Minister of Public Health, Social Development, and Labor, Richinel Brug, has taken note of the Ombudsman's announcement regarding the launch of a systemic investigation into the administrative practices of Social and Health Insurances (SZV), particularly as it relates to the Medical Referral Abroad program.

Minister Brug stated that, while it is unfortunate that circumstances have led to such an investigation, he recognizes and respects the important role of the Ombudsman in safeguarding transparency, accountability, and adherence to the law within public institutions.

“Ensuring that our institutions operate within the framework of the law and according to the principles of good governance is essential,” Minister Brug said. “From a transparency perspective, this investigation provides an opportunity to review how processes are being applied and whether improvements are necessary.”

The Minister emphasized that referrals for medical treatment abroad remain a critical component of Sint Maarten’s healthcare system, particularly for specialized services that cannot currently be provided locally.

Each year, SZV facilitates around 800 medical referrals abroad for insured persons who require specialized treatment. Ensuring that patients receive the care they require, while protecting their rights throughout the process, remains a priority.

“In many instances, patients must travel abroad to access specialized medical services that are not available on Sint Maarten,” Minister Brug explained. “It is therefore essential that the policies, procedures, and administrative practices governing these referrals are clear, lawful, and centered on the best interests of the patients we serve.”

Minister Brug further noted that, beyond the medical component of these referrals, the logistical aspects of the process must also be clearly regulated.

“While medical referrals are necessary to ensure patients receive care that cannot be provided locally, the policies governing the logistical aspects of these referrals — such as travel arrangements, accommodation, and the rules and responsibilities that apply while patients are abroad — must also be clearly defined, transparent, and consistently applied. Equally important is that patients who benefit from this service understand and adhere to the rules and responsibilities that come with it” the Minister stated.

Minister Brug indicated that he views the investigation as an opportunity to review existing SZV policies and strategies, particularly those that may be outdated and in need of modernization.

“This moment allows us to take a closer look at whether certain policies or operational procedures require updating to better reflect current realities,” the Minister stated. “Our goal must always be to strengthen the system in a way that protects patients, ensures transparency in decision-making, and safeguards the integrity of SZV as an institution.”

The Minister also confirmed that both his Ministry and SZV will fully cooperate with the Ombudsman’s investigation and will respond to the questions posed within the timeframe provided.

“Draco” Case and Related Investigations Concluded Through Agreements and Settlements.

PHILIPSBURG:--- The Prosecutor’s Office (OM) has officially announced the conclusion of the “Draco” case on appeal by the Joint Court of Justice. This resolution follows procedural agreements reached between the OM, suspect Silvio J. Matser, and his defense attorneys, Safira Ibrahim and Marcel van Gessel. Additionally, the related confiscation case and the “Draco 2” investigations have been resolved through financial settlements, bringing an end to all criminal and confiscation proceedings involving Matser.

PHILIPSBURG:--- The Prosecutor’s Office (OM) has officially announced the conclusion of the “Draco” case on appeal by the Joint Court of Justice. This resolution follows procedural agreements reached between the OM, suspect Silvio J. Matser, and his defense attorneys, Safira Ibrahim and Marcel van Gessel. Additionally, the related confiscation case and the “Draco 2” investigations have been resolved through financial settlements, bringing an end to all criminal and confiscation proceedings involving Matser.

The settlement funds will be deposited into the Crime Fund. With this resolution, the cases against Matser and three companies affiliated with him have been finalized. Matser will soon receive a summons to begin serving his prison sentence.

The “Draco” investigation, initiated on November 8, 2018, was conducted by the Kingdom Cooperation Team (RST) under the supervision of the Central Team of the Attorney-General’s Office for Curaçao, Sint Maarten, Bonaire, St. Eustatius, and Saba.

On February 10, 2022, the Court of First Instance (GEA) sentenced Matser to 22 months of unconditional imprisonment for intentionally failing to file tax returns, submitting incorrect tax returns, and money laundering. The court also ordered the execution of a previously suspended prison sentence. Three additional individuals were convicted as part of the investigation. Both Matser and the Prosecutor’s Office appealed the judgment.

In parallel with the criminal case, the RST launched a Criminal Financial Investigation to determine whether the suspects in the “Draco” case had unlawfully gained financial benefits. The investigation revealed that Matser had enriched himself through the crimes for which he was convicted, prompting the Prosecutor’s Office to initiate confiscation proceedings.

Following Matser’s conviction, the OM also launched a criminal investigation and confiscation proceedings against three companies linked to him. The “Draco 2” investigation focused on allegations of forgery and money laundering. Earlier this year, agreements were reached between the OM, Matser, and his defense team to resolve all these cases.

The appeal in the “Draco” criminal case was concluded by the Joint Court of Justice in accordance with the procedural agreements made between the OM, Matser, and his defense. Procedural agreements are arrangements between the Prosecutor’s Office and the suspect, outlining the desired case outcome. These agreements are submitted to the court for review and approval. While the court is not obligated to accept them, the Joint Court deemed the proposed resolution reasonable and appropriate, issuing a judgment accordingly.

As a result, Matser has been sentenced on appeal to 21 months of unconditional imprisonment. The request to enforce the previously suspended prison sentence was rejected. The one-month reduction in the prison sentence compared to the initial ruling reflects the excessive duration of the appeal process.

The overall agreement with Matser includes his acceptance of the prison sentence and a settlement of 711,045 XCG in the confiscation case, relinquishing unlawfully obtained personal assets. Consequently, the OM will request the Court of First Instance to declare the confiscation case concluded.

Additionally, the pending criminal and confiscation cases against three companies affiliated with Matser have been resolved. Two companies will not face prosecution, as their unlawful gains were already included in Matser’s personal confiscation settlement. The third company will pay a fine of $20,000 and a confiscation settlement of $324,215.

This marks the first instance in the Caribbean part of the Kingdom where a criminal case on appeal has been resolved through procedural agreements. This approach allows for quicker case resolution with fewer procedural steps, saving significant government resources in terms of time, court capacity, and costs. At the same time, the requirement for court approval ensures fairness and equality before the law.