CCF invites individuals, organizations, and institutions to submit their cultural and creative projects. Selection will be based on respect for CCF’s values, alignment with the themes of each call, the quality and feasibility of proposals, and the proven abilities of project leaders. We invite applicants to write their projects simply and clearly, paying particular attention to the relationship between objectives and budget, and to consider implementation constraints.

For more information on the Caribbean Culture Fund and each call, visit our website: caribbeanculturefund.org

Call 4.1: Art for Change – Deadline March 1, 2026

CCF will award 10 grants of USD 10,000 for projects that demonstrate the use of arts and culture to catalyze change.

The Art for Change theme invites creatives and cultural organizations to explore the transformative power of art in shaping the Caribbean. We seek projects that give voice to the region’s aspirations, challenges, and triumphs, and that address the changes artists wish to see in their communities, nations, and the broader Caribbean. This theme encourages artists to imagine, critique, and reimagine the Caribbean, using their work as a catalyst for social commentary, engagement, education, reflection, positive change, and new developments. We welcome proposals that showcase innovative and impactful art practices, from visual arts to performance, literature, and beyond, that contribute to a vibrant and inclusive Caribbean narrative.

Call 4.2: Caribbean Collaboration – Deadline March 1, 2026

CCF will award 4 grants of USD 25,000 for projects that reflect or catalyze intra-regional cooperation and promote the arts across linguistic and geographic boundaries within the Caribbean and its diasporas.

This theme invites projects that reflect connections within the Caribbean community. Applicants must work with a collaborator based in another Caribbean country or territory, and this partner or partners must be meaningfully included in the design and implementation of the project. The project must be multi-country or multi-territory in scope and execution; for example, bringing the work of creatives from different countries to one or more countries. Projects that reflect connections to the larger African diaspora and the legacy of African and Indigenous cultures in the Caribbean will also be considered.

Call 5: Residencies and Fellowships – Deadline March 15, 2026

CCF will award 10 grants of USD 5,000 to support short-term, intra-Caribbean residencies and fellowships.

CCF invites cultural institutions and organizations with residential capacity to submit proposals for artist residencies and fellowships. The CCF grant must cover all costs, including visa, travel, accommodation, meals, and interpretation, for up to a maximum of two artists from any Caribbean country or territory other than that of the applicant. The residencies should foster creative exchange, collaboration, and innovation across diverse artistic disciplines and cultural contexts.

Through this call, CCF seeks to create meaningful opportunities for artistic growth, facilitate connections among artists, institutions, and communities, and strengthen the cultural and social ecosystem of the Caribbean region. Priority will be given to organizations that have hosted residencies in the past three years and that have preselected the artist(s) at the time of application. The residencies and fellowships may be open to practitioners from any artistic discipline. Selected artists must be willing to participate in at least one public activity during the residency period and at least one virtual event hosted by CCF.

Upcoming Sessions:

Call 4: Grant Writing with Marielle Barrow – February 23, 10:00–11:30 AM (EST)

Registration: https://us06web.zoom.us/meeting/register/1jK4LlWWTUuD8O14ngmKEg

Call 4: Q&A Session – February 26, 10:00–11:00 AM (EST)

Registration: https://us06web.zoom.us/meeting/register/nJdV-uj2TtCfmZEccGbJOg

Call 4: Submittable Support – February 27, 10:00–11:00 AM (EST)

Registration: https://us06web.zoom.us/meeting/register/WNbiwcFMR5-xGumQxyD72A

Call 5: Orientation – February 24, 10:00–11:00 AM (EST)

Registration: https://us06web.zoom.us/meeting/register/IUf438ivSkyAe8KqG4ooIA

Call 5: Q&A Session – March 3, 10:00–11:00 AM (EST)

Registration: https://us06web.zoom.us/meeting/register/xtkiQRJvS8CieXburPsV9w

Call 5: Residencies Call Submittable Support – March 10, 10:00–11:00 AM (EST)

Registration: https://us06web.zoom.us/meeting/register/YefznCELQ6C_583sR2pWhg

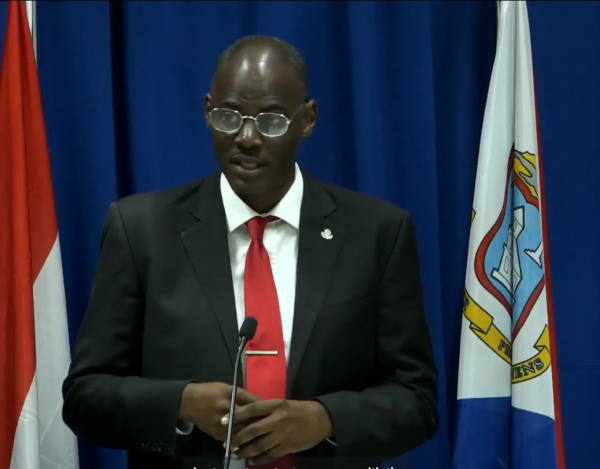

PHILIPSBURG:--- The Ministry of Public Health, Social Development and Labor (VSA) hereby informs the public that Minister Brug has joined forces with local artist King Vers to launch a new awareness initiative focused on men’s mental health on Sint Maarten.

PHILIPSBURG:--- The Ministry of Public Health, Social Development and Labor (VSA) hereby informs the public that Minister Brug has joined forces with local artist King Vers to launch a new awareness initiative focused on men’s mental health on Sint Maarten. PHILIPSBURG:--- The Sint Maarten Tax Administration reminds the public that the deadline to complete payments and collect the 2026 Motor Vehicle Stickers is fast approaching.

PHILIPSBURG:--- The Sint Maarten Tax Administration reminds the public that the deadline to complete payments and collect the 2026 Motor Vehicle Stickers is fast approaching. PHILIPSBURG:--- The Sint Maarten Science Fair Foundation is pleased to announce the winner of its 2026 Poster Competition, held under the theme “Innovate for Wellbeing.” The poster competition forms part of Science Week 2026, which will take place from March 9 to March 13, 2026, and will conclude with an award ceremony on March 21, 2026.

PHILIPSBURG:--- The Sint Maarten Science Fair Foundation is pleased to announce the winner of its 2026 Poster Competition, held under the theme “Innovate for Wellbeing.” The poster competition forms part of Science Week 2026, which will take place from March 9 to March 13, 2026, and will conclude with an award ceremony on March 21, 2026. PHILIPSBURG:--- “There’s something powerful about women shaping policy.” These were the words of Cassandra Richardson, Director of Victim Support Services (VSS), as her team welcomed members of the Women’s Caucus of Parliament to the VSS Headquarters for a private engagement focused on survivor protection, legislative reform, and strengthening national support systems.

PHILIPSBURG:--- “There’s something powerful about women shaping policy.” These were the words of Cassandra Richardson, Director of Victim Support Services (VSS), as her team welcomed members of the Women’s Caucus of Parliament to the VSS Headquarters for a private engagement focused on survivor protection, legislative reform, and strengthening national support systems.